%E5%85%A8%E5%B9%B4%E4%B8%AA%E4%BA%BA%E6%89%80%E5%BE%97%E7%A8%8E%E5%BA%94%E7%BA%B3%E7%A8%8E%E5%90%88%E8%AE%A1.png)

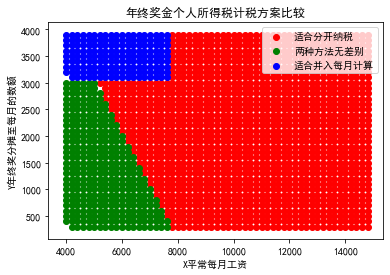

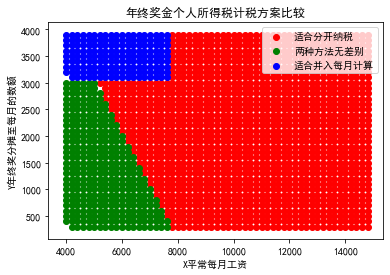

年终奖个人所得税计算方案:

方案一:年终奖单独计算,不分摊并入每月工资计算纳税

方案二:年终奖分摊并入每月工资计算纳税

#%%cell1

# -*- coding: utf-8 -*-

"""

import xlwt

import numpy as np

x=np.arange(4000,15000,200)

y=np.arange(300,4000,100)

# x=8000;

# y=3000;

#月工资与年终奖分开算,即年终奖不分摊到每月,年总为Z

a=b=c=1

workbook = xlwt.Workbook() # 新建一个工作簿

sheet1 = workbook.add_sheet("适合分开纳税") # 在工作簿中新建一个表格

sheet1.write(0, 1, "正常月工资")

sheet1.write(0, 2, "年终兑现评弹月奖金")

sheet1.write(0, 3, "最低纳税额")

sheet2 = workbook.add_sheet("适合并入每月计算") # 在工作簿中新建一个表格

sheet2.write(0, 1, "正常月工资")

sheet2.write(0, 2, "年终兑现评弹月奖金")

sheet2.write(0, 3, "最低纳税额")

sheet3 = workbook.add_sheet("两种方法无差别") # 在工作簿中新建一个表格

sheet3.write(0, 1, "正常月工资")

sheet3.write(0, 2, "年终兑现评弹月奖金")

sheet3.write(0, 3, "最低纳税额")

#月工资与年终奖合并计算,即年终奖分摊到每月,年总为P

for m in range(0,len(x),1):

for n in range(0,len(y),1):

if (x[m]-5000) <= 3000:

X = (x[m]-5000)*0.03-0

elif (x[m]-5000) <= 12000:

X = (x[m]-5000)*0.1-210

elif (x[m]-5000) <= 25000:

X = (x[m]-5000)*0.2-1410 #Z=12*X+Y

if y[n] <= 3000:

Y = 12*y[n]*0.03-0

elif y[n] <= 12000:

Y = 12*y[n]*0.1-210

elif y[n] <= 25000:

Y = 12*y[n]*0.2-1410 #Z=12*X+Y

if (x[m]+y[n]-5000) <= 3000:

P = 12*((x[m]+y[n]-5000)*0.03-0)

elif (x[m]+y[n]-5000) <= 12000:

P = 12*((x[m]+y[n]-5000)*0.1-210)

elif (x[m]+y[n]-5000) <= 25000:

P = 12*((x[m]+y[n]-5000)*0.2-1410)

if (12*X+Y-P) < 0:

print("适合分开纳税:")

print(x[m],y[n],12*X+Y-P)

print("正在写入数据")

sheet1.write(a, 1, str(x[m])) # 表格中写入数据(对应的行和列)

sheet1.write(a, 2, str(y[n]))

sheet1.write(a, 3, str(12*X+Y))

workbook.save("C:\\Users\\Administrator\\Desktop\\个人所得税计算.xls") # 保存工作簿

a=a+1

elif (12*X+Y-P) > 0:

print("适合并入每月计算:")

print(x[m],y[n],12*X+Y-P)

print("正在写入数据")

sheet2.write(b, 1,str(x[m])) # 表格中写入数据(对应的行和列)

sheet2.write(b, 2,str(y[n]))

sheet2.write(b, 3,str(P))

workbook.save("C:\\Users\\Administrator\\Desktop\\个人所得税计算.xls") # 保存工作簿

b=b+1

elif (12*X+Y-P) == 0:

print("两种方法无差别:")

print(x[m],y[n],12*X+Y-P)

print("正在写入数据")

sheet3.write(c, 1,str(x[m])) # 表格中写入数据(对应的行和列)

sheet3.write(c, 2,str(y[n]))

sheet3.write(c, 3, str(12*X+Y))

c=c+1

workbook.save("C:\\Users\\Administrator\\Desktop\\个人所得税计算.xls") # 保存工作簿

#%%cell2

from mpl_toolkits.mplot3d import Axes3D

from matplotlib import pyplot as plt

import pandas as pd

#读取工作簿和工作簿中的工作表

data1_frame=pd.read_excel('C:\\Users\\Administrator\\Desktop\\个人所得税计算.xls',sheet_name='适合分开纳税')

x1=data1_frame.iloc[1:,1]

y1=data1_frame.iloc[1:,2]

z1=data1_frame.iloc[1:,3]

data2_frame=pd.read_excel('C:\\Users\\Administrator\\Desktop\\个人所得税计算.xls',sheet_name='两种方法无差别')

x2=data2_frame.iloc[1:,1]

y2=data2_frame.iloc[1:,2]

z2=data2_frame.iloc[1:,3]

data3_frame=pd.read_excel('C:\\Users\\Administrator\\Desktop\\个人所得税计算.xls',sheet_name='适合并入每月计算')

x3=data3_frame.iloc[1:,1]

y3=data3_frame.iloc[1:,2]

z3=data3_frame.iloc[1:,3]

#绘制2维坐标图

plt.rcParams['font.sans-serif']=['SimHei'] #用来正常显示中文标签

plt.rcParams['axes.unicode_minus']=False #用来正常显示负号

plt.scatter(x1,y1,c = 'r',marker = 'o',label = '适合分开纳税')

plt.scatter(x2,y2,c = 'g',marker = 'o',label='两种方法无差别')

plt.scatter(x3,y3,c = 'b',marker = 'o',label='适合并入每月计算')

plt.legend(loc = 'upper right')

plt.title('年终奖金个人所得税计税方案比较')

plt.ylabel('Y年终奖分摊至每月的数额')

plt.xlabel('X平常每月工资')

plt.show()

# 绘制3D散点图

fig = plt.figure()

ax = Axes3D(fig)

ax.scatter(x1, y1, z1, c='r', label = '适合分开纳税')

ax.scatter(x2, y2, z2, c='g', label = '两种方法无差别')

ax.scatter(x3, y3, z3, c='b', label = '适合并入每月计算')

ax.legend(loc = 'upper right')

# 添加坐标轴(顺序是Z, Y, X)

ax.set_title('(年终奖+平常每月工资)全年个人所得税应纳税合计')

ax.set_zlabel('Z全年应纳税额')

ax.set_ylabel('Y年终奖分摊至每月的数额')

ax.set_xlabel('X平常常每月工资额')

%E5%85%A8%E5%B9%B4%E4%B8%AA%E4%BA%BA%E6%89%80%E5%BE%97%E7%A8%8E%E5%BA%94%E7%BA%B3%E7%A8%8E%E5%90%88%E8%AE%A1.png)